Improving the Experience of Handling Fraud Claims

Service

UX Consultancy

Client

Bancolombia

Agency

Usaria, 2022

Agency

Usaria, 2022

Client

Bancolombia

Service

UX Consultancy

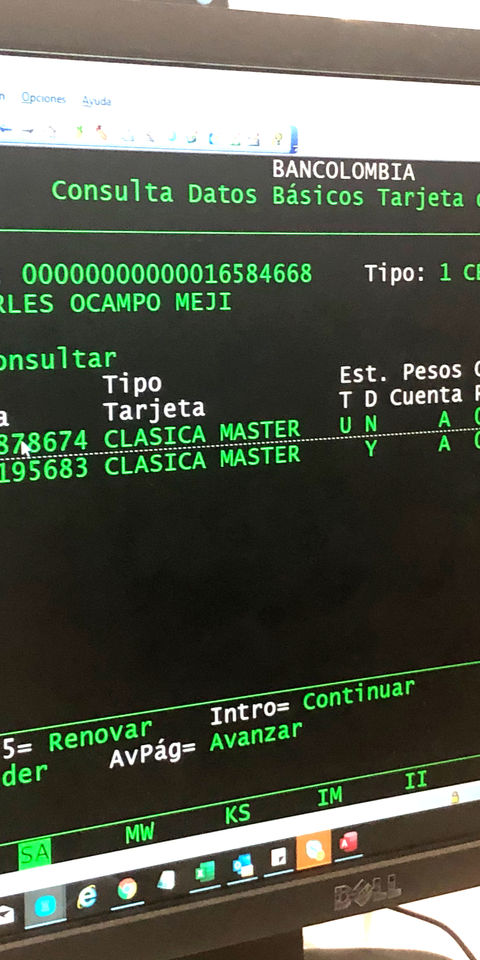

Handling fraud claims related to credit and debit card transactions is a complex and time-consuming process. When a customer identifies an issue—such as duplicate charges or unauthorized transactions—a dispute is filed with the merchant, which then notifies the bank to initiate a reversal.

This process is costly and labor-intensive, averaging $35 USD per claim, and typically involves multiple disconnected systems and heavy manual data entry, resulting in errors and operational inefficiencies.

The Challenge

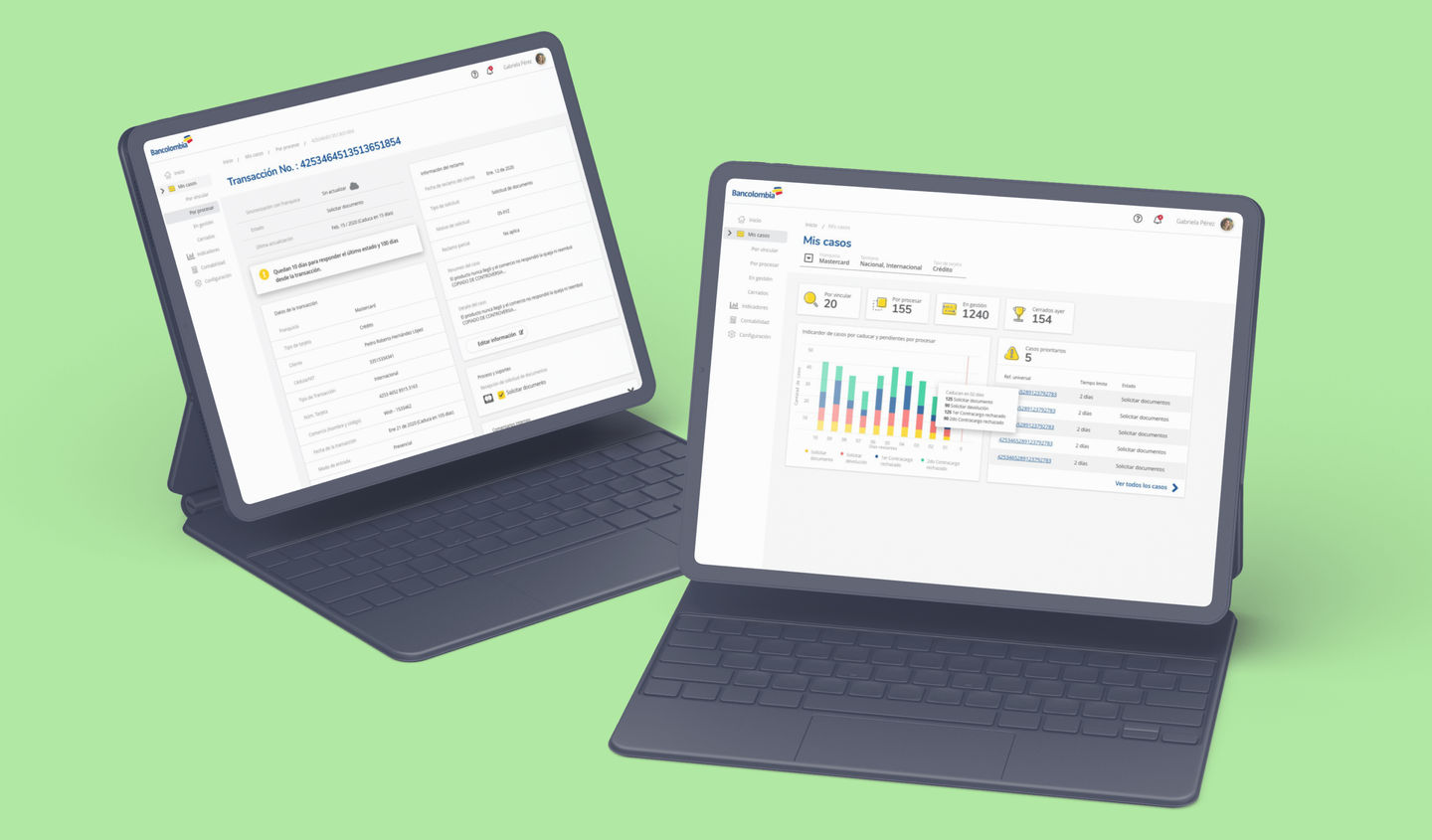

To streamline and unify the fraud claim reversal process within a single application, improving efficiency, reducing human error, and lowering operational costs.

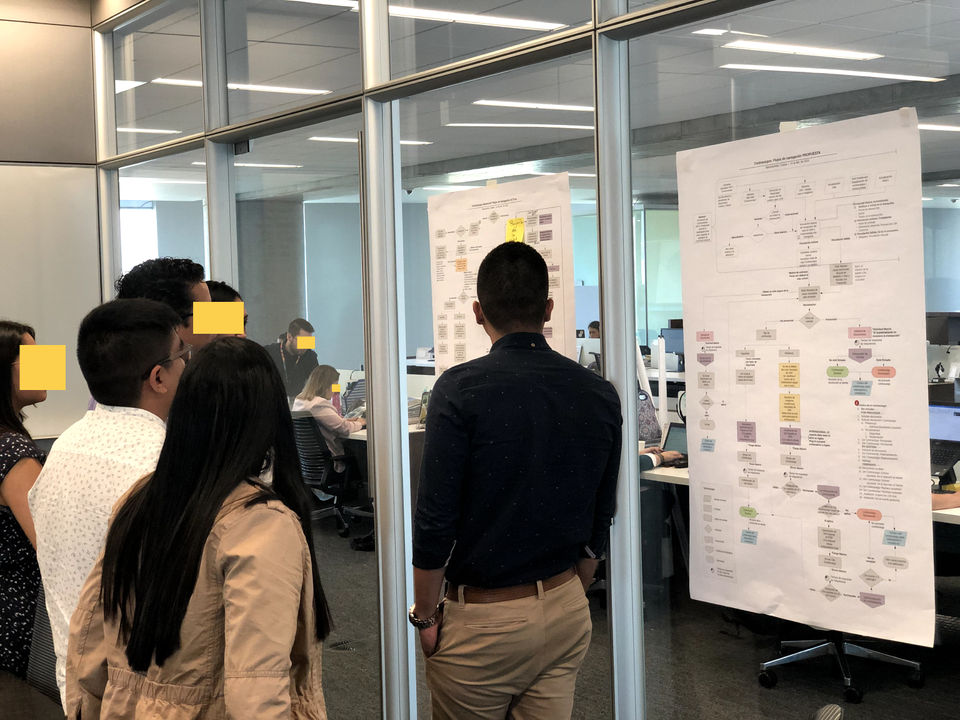

I led the qualitative research strategy and execution to understand how fraud claims were currently processed. This included contextual observation of operational workflows, analysis of tools and systems, and identification of automation and integration opportunities.

In addition, I led the information architecture for the unified system and designed and facilitated a co-creation workshop with stakeholders to refine the proposed solution collaboratively.

Timeline

4 weeks – research, process mapping, ideation, and validation.

Research statement and goals

Understand the operational bottlenecks in fraud reversals to design a digital solution that:

→ Reduces the number of platforms used.

→ Automates repetitive tasks.

→ Increases processing speed and consistency.

Success criteria

Consolidation of fragmented tools into a unified platform.

Reduction in manual input and duplication.

Improved processing time per claim.

Research methodology

Contextual shadowing of reversal agents.

Interviews with operational team members.

System analysis of macros and data transfer workflows.

Process mapping and feature co-creation.

Recruitment criteria and process

The study focused on the three fraud claim specialists managing day-to-day operations. We prioritized observing real-time tasks, bottlenecks, and system behavior.

Sharing and activation

Findings were shared with the product and engineering teams through visual journey maps and opportunity briefs. We co-designed a system architecture proposal to automate 70% of repetitive actions

Approach

Outputs & deliverables

Full process map of the fraud reversal flow.

Blueprint for a unified software platform, including:

Real-time receipt of case documentation

Case history retrieval

Decision logic for reversals

Deadline and expiration management

Matrix of manual vs. automated steps

Value proposal to align stakeholders and drive product implementation

O3

Disproportionate operational workload

Just three team members processed nearly 100 cases per day, facing frequent system crashes and inefficient flows. Most tasks were highly mechanical, leaving little space for strategic oversight and increasing burnout risk.

O2

Operational fragmentation and error risk

Reversal cases were handled manually across six different platforms, involving repetitive tasks, local macros, and manual data exports. This fragmentation led to frequent errors, processing delays, and over-reliance on fragile tools.

O1

High automation potential

Approximately 70% of the workflow could be automated through rule-based logic and system integration—an immediate opportunity to redesign the operation with measurable gains in efficiency, scalability, and cost reduction.

Key findings

Business Value

Impact

The proposal enabled Bancolombia to visualize a new operational model that is more efficient, scalable, and resilient. It reduces dependency on fragile macros, accelerates decision-making, and improves operational performance.

Estimated benefits include:

→ Up to 70% reduction in manual workload

→ Fewer errors due to tool fragmentation

→ Greater capacity to handle volume without increasing headcount

→ Foundation for future integration with AI‑based fraud detection

Reflections

This project highlighted the importance of designing internal experiences—not just those visible to customers. By addressing operational pain points, we unlocked value for both the business and the teams behind the scenes. Empowering staff through better tools not only reduces costs—it also builds resilience into critical systems where trust and timing are everything.